💳 CFPB on Card Late Fee

- Frank Tian

- Apr 18, 2022

- 1 min read

Updated: Dec 21, 2022

CFPB published a comprehensive report on credit card late fees on March 29, 2022.

In 2020, a total of $12 billion in late fees were charged.

This is about 10% of total credit card interest and fees.

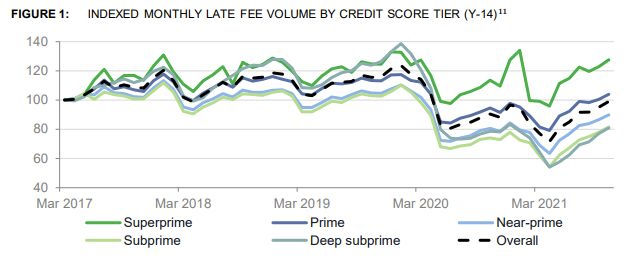

The fees decreased since the start of the pandemic,

With both government assistance and lenders’ forbearance programs.

Since April 2021, they are on the way back to 2019 levels.

The average late fee is $31 in 2019.

The first late fee is $26-27 vs. the repeated late fee of $34-35.

The median value of the max late fee in a credit agreement is $21-25.

Large issuers have the max late fees higher at $36-$40.

The Background:

As the financial cushion built during the pandemic begins to dwindle,

The financial cost is back to the attention of regulators.

In January, CFPB launched an initiative targeting the so-called junk fees.

By mid-March, it had already received over 25,000 comments.

The deadline to accept comments has now been extended to April 11.

The CFPB report: Credit card late fees report

Comments