Impact of Payment Pause on Credit Scores of US Student Loan Holders

- Frank Tian

- Apr 8, 2022

- 1 min read

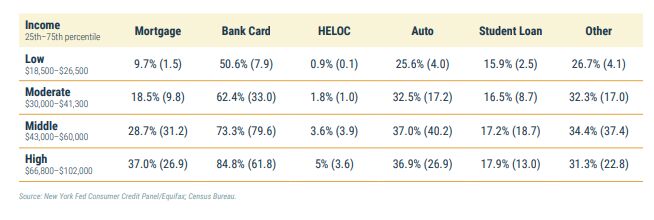

3 highlights from NY Fed’s latest consumer credit analysis by income:

👉 The lower-income group holds comparable auto loans and student loans vs. higher-income groups, from both:

Percent of the population holding debt (graph 1)

median balance (graph 2).

👉 The growing balance of secured debt (auto loan and mortgage) and the shrinking of credit card debt are across all income groups.

👉 The credit scores for student loan holders were boosted more sharply (graph 3) due to the pause in the payment.

Source:

Data:

As of Q3 ‘21.

Source: Federal Reserve Bank of New York, "The State of Low-Income America: Credit Access and Debt Payment", March 2022.

Comments